After sitting on the market for exactly 730 days, the London home owned by television personalities Vogue Williams and Spencer Matthews has finally seen a price cut — a move that signals both frustration and strategy in one of the world’s most competitive housing markets. The announcement came via an Instagram post from Williams on her verified account, though no official date was given. What’s clear: after two full years with zero offers, the couple decided to stop waiting and start adjusting.

Why Two Years Is an Eternity in London Real Estate

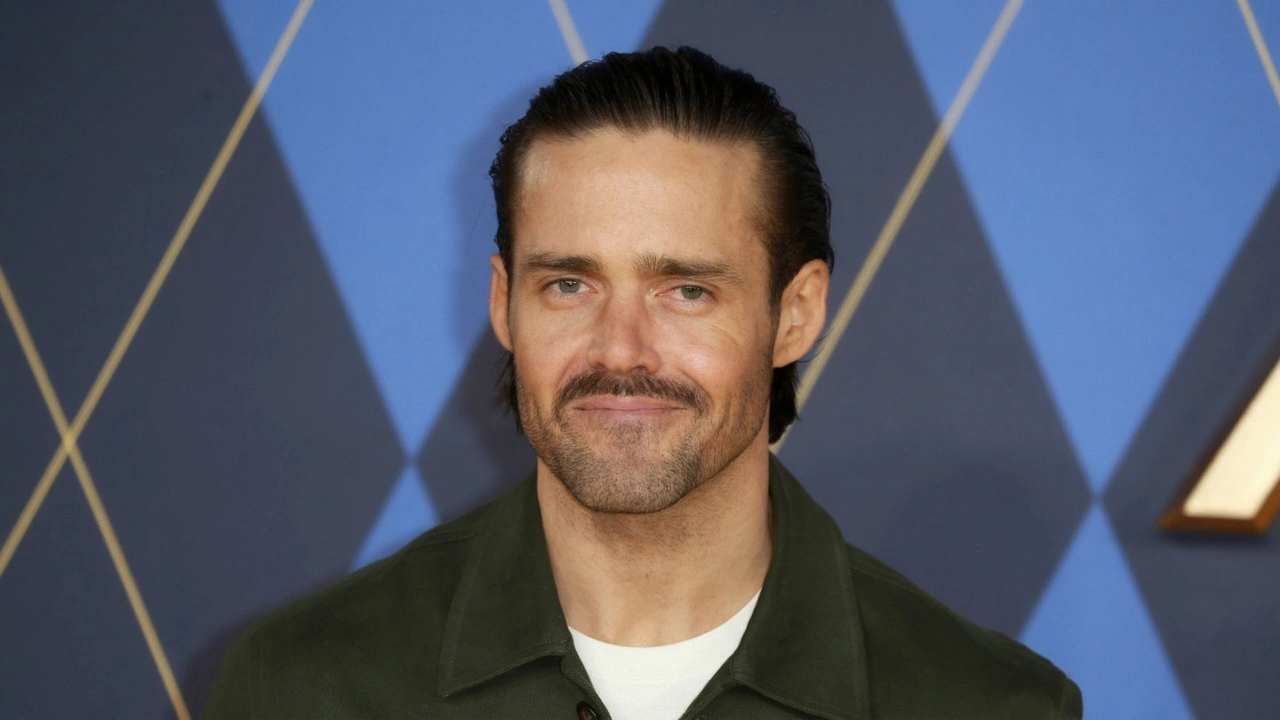

In London’s luxury property market, homes typically sell within 60 to 90 days if priced right. Two years? That’s not just unusual — it’s a red flag. Even in a cooling market, properties that linger beyond a year often have underlying issues: overpricing, structural flaws, or mismatched buyer expectations. The fact that this home sat untouched for 730 days suggests one of two things: either the initial listing price was wildly out of step with reality, or the property’s appeal didn’t match the buyer pool that could afford it.Williams and Matthews aren’t just any sellers. Known for their appearances on Love Island and The Only Way Is Essex, they’ve built a public brand around luxury living. Their home, located somewhere in the capital’s affluent boroughs (though the exact neighborhood remains undisclosed), likely features high-end finishes, prime location perks, and perhaps even celebrity cachet. Yet none of that moved the needle. That’s the twist: fame doesn’t always translate to fast sales.

The Price Cut — And What It Might Mean

The term "slashed" was used in the announcement, and in real estate, that’s code for a dramatic reduction — likely 20% or more. While the original and new prices remain unconfirmed, industry insiders estimate that luxury homes in areas like Kensington, Chelsea, or Hampstead that stay on the market over 18 months often see cuts of £300,000 to £500,000. Given the couple’s profile, it’s reasonable to assume their home was initially listed at £3 million or higher. A 25% reduction would bring it into the £2.25 million range — still a luxury price, but one that might finally attract serious buyers.What’s interesting is how they announced it: through Instagram, not a traditional estate agent. That’s a deliberate move. By bypassing brokers, they’re controlling the narrative — and possibly testing the market’s pulse before re-listing. It also tells buyers they’re not desperate. They’re recalibrating. That’s smart.

Market Context: London’s Cooling Luxury Segment

London’s high-end property market has been under pressure since 2022. Interest rate hikes, inflation, and the cost-of-living crisis have pushed many ultra-wealthy buyers to pause. According to data from Knight Frank, prime London property prices fell 4.3% in 2023 — the steepest drop in a decade. The number of homes selling above £2 million dropped by 17% year-over-year. In this environment, even a beautiful, well-located home can struggle if it’s priced for a different era.Williams and Matthews’ property likely hit the market in early 2022, when buyer confidence was still high and mortgage rates hovered near historic lows. Today, those same buyers are calculating monthly payments differently. A £3 million home with a 25% down payment now carries a mortgage of £2.25 million — and at 5.5% interest, that’s over £13,000 a month. That’s not just a stretch — it’s a financial stretch too far for many.

What’s Next for the Couple and Their Home

The price reduction doesn’t guarantee a sale — but it does reset the conversation. The next move will be key: will they stage the home differently? Offer flexible terms? Lower the price again if needed? Real estate agents say homes that drop in price after 18+ months often attract investors looking for bargains, or overseas buyers who missed the initial buzz. There’s also the chance a buyer who once walked away now returns, seeing the cut as a sign the sellers are serious.For Williams and Matthews, the home may have become more of a liability than an asset. Property taxes, maintenance, and insurance add up — especially in London. Holding onto it another year could cost them tens of thousands. The price cut isn’t just about selling — it’s about cutting losses.

Why This Matters Beyond Celebrity Real Estate

This isn’t just a tabloid story. It’s a case study in how the luxury housing market is changing. Even high-profile sellers aren’t immune to market forces. What worked in 2021 doesn’t work in 2024. Buyers are more cautious. Sellers are more pragmatic. And social media? It’s now the new open house.Williams and Matthews’ decision to announce the cut publicly — not through a broker, not in a press release, but on Instagram — reflects a broader shift. The old rules of real estate are fading. Transparency, speed, and direct communication are winning. If their home sells quickly after this cut, expect other celebrities to follow suit.

Frequently Asked Questions

How much might the price have been slashed?

While exact figures aren’t public, industry estimates suggest a reduction of 20–30%, likely between £500,000 and £750,000. Given London’s luxury market, the original listing was probably around £3 million, bringing the new price to approximately £2.25 million — still high, but within reach for a new wave of buyers.

Why did it take two years to sell?

The home likely suffered from overpricing in a cooling luxury market. With mortgage rates rising and global buyers pulling back, properties priced above £2.5 million struggled to find buyers. Even celebrity appeal couldn’t override economic reality — and without offers, the only option was to adjust.

Why announce it on Instagram instead of through an estate agent?

Using Instagram gives them direct control over the message and avoids broker fees. It also leverages their public following to generate buzz — turning a real estate move into a viral moment. Many high-net-worth sellers now use social media to test interest before re-listing officially.

Is this a sign of broader trends in London’s property market?

Absolutely. Prime London property sales have dropped 17% since 2022, and homes staying on the market beyond 18 months are increasingly common. Sellers are being forced to lower prices, offer incentives, or wait longer. Williams and Matthews’ move mirrors what’s happening across the city — even among the wealthy.

Could the property still fail to sell after the price cut?

Yes — if the property has hidden issues like poor layout, outdated interiors, or location-specific drawbacks (e.g., noise, lack of parking), even a lower price won’t help. Buyers today are more discerning. The cut resets expectations, but the home still needs to deliver on value, not just price.

What’s the financial impact of holding onto the property for two years?

Beyond the lost sale opportunity, annual costs include council tax (up to £3,500), maintenance (at least £10,000/year), insurance (£1,500+), and potential mortgage interest if financed. Conservatively, they’ve spent over £50,000 just holding the property — not counting depreciation or missed investment returns.